Mumbai, 23 December 2023

Kotak T.U.L.I.P – Life Insurance Savings, ULIP Plan offered by Kotak Life

Introduction:

Kotak T.U.L.I.P, a protection-oriented Unit Linked Insurance Plan, has been introduced by Kotak Life Insurance, offering an innovative blend of life cover and investment. This plan is designed to cater to individuals seeking a robust financial tool for wealth growth and family security.

Warning:Read disclaimer in the footer of this article.

Here is a tabular summary of the key features of the Kotak T.U.L.I.P plan:

| Feature | Description |

|---|---|

| High Sum Assured | Option to choose a high sum assured multiple for significant life cover. |

| Return of Premium Allocation Charges | 2X return of premium allocation charges from the end of the 10th policy year onwards. |

| Return of Mortality Charges | Up to 3X return of mortality charges on survival starting from the 11th policy year onwards. |

| Loyalty Additions | Rewards for staying invested to enhance maturity value on maturity. |

| Premium Payment Flexibility | Flexibility to pay premium for a limited duration or throughout the policy term. |

| Rider Options | Options to enhance protection through various rider choices. |

| Investment Strategies | Multiple investment strategies to choose from, catering to different investment needs. |

| Death Benefit | Provides financial security to beneficiaries in case of the life insured’s demise during the policy term. |

| Maturity Benefit | Payment of the available fund value on survival till maturity to fulfill investment objectives. |

| Tax Benefits | Offers tax benefits under the Income-tax Act, 1961, subject to conditions. |

| Partial Withdrawals | Option for partial withdrawals after completion of 5 policy years for liquidity. |

| Additional Features | Includes top-up premiums, policy discontinuance options, switching and premium redirection, and the ability to decrease the basic sum assured. |

| Eligibility | Entry age from 18 to 60 years, maturity age from 48 to 100 years, with various policy terms and premium payment terms available. |

These features collectively highlight the plan’s focus on providing life coverage along with investment benefits, ensuring a comprehensive financial solution for policyholders.

Key Advantages:

- High Sum Assured Options: Policyholders can select a high sum assured multiple, ensuring substantial life coverage.

- Return of Charges: The plan offers a return of 2X Premium Allocation Charges from the 10th policy year and up to 3X Return of Mortality Charges from the 11th year, enhancing fund value.

- Loyalty Additions: Rewards for long-term investment include loyalty additions, ranging from 22% to 30% based on the policy term and premium payment term.

- Flexible Premium Payment: Options for limited or regular premium payments throughout the policy term.

- Rider Options: Additional protection is available through riders like Kotak Accidental Death Protection Rider and Kotak Critical Illness Benefit Rider.

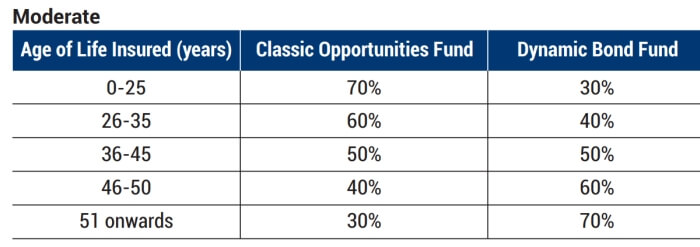

- Investment Strategies: Two investment strategies – Self Managed Strategy and Age Based Strategy – cater to different risk-return profiles.

Wealth Maximization and Protection:

Kotak T.U.L.I.P emphasizes on maximizing wealth alongside offering protection. The plan provides higher life insurance coverage alongside the opportunity to grow wealth over the long term. In case of the insured’s demise, beneficiaries receive a substantial death benefit, ensuring financial security.

Death and Maturity Benefits:

- Death Benefit: In the event of the policyholder’s demise, the plan pays the highest of the basic sum assured, fund value, or 105% of the total premiums paid. This benefit ensures family financial stability.

- Maturity Benefit: On survival till the policy term’s end, the fund value, including loyalty additions, is payable, aiding in fulfilling investment objectives.

Liquidity Options:

Kotak T.U.L.I.P allows partial withdrawals after five policy years, providing liquidity to meet unexpected financial needs.

Additional Features:

- Top-Up Premiums: Option to increase investment contributions.

- Policy Discontinuance: Flexibility for policy discontinuance with applicable charges.

- Switching and Premium Re-direction: Options to switch between fund options or change future premium allocations.

- Decrease in Basic Sum Assured: Option to decrease the basic sum assured to maintain life cover without changing premiums.

Eligibility Criteria:

- Entry Age: 18 to 60 years.

- Maturity Age: 48 to 100 years.

- Policy Term: 30 to 40 years.

- Premium Payment Terms: Limited Pay (10, 12, 15 years) or Regular Pay (same as policy term).

- Premium Levels: Minimum premium requirements based on the mode of payment.

- Min: Rs. 1,00,000 p.a. (Annual Mode); Rs. 1,20,000 p.a. (other modes).

Fund Options offered by Kotak Life Insurance

Here’s a tabular overview of the funds offered by Kotak Life Insurance:

| Fund Name | Objective | Risk-Return Profile | Equity Allocation | Debt Allocation | Money Market Allocation |

|---|---|---|---|---|---|

| Classic Opportunities Fund | Maximize long-term capital growth with large/medium equities | Aggressive | 75-100% | 0-25% | 0-25% |

| Frontline Equity Fund | High level of capital growth with large company equities | Aggressive | 60-100% | 0-40% | 0-40% |

| Kotak Mid Cap Advantage Fund | Long-term growth with medium and small company equities | Aggressive | 75-100% | 0-25% | 0-25% |

| Balanced Fund | Moderate growth with a mix of equities and fixed instruments | Moderate | 30-60% | 20-70% | 0-40% |

| Dynamic Bond Fund | Preserve capital with high-quality corporate bonds | Conservative | – | 60-100% | 0-40% |

| Dynamic Floating Rate Fund | Minimize interest rate risk with floating rate debt instruments | Conservative | – | 60-100% | 0-40% |

| Dynamic Gilt Fund | Safety of capital with Government Securities | Conservative | – | 80-100% | 0-20% |

| Money Market Fund | Protect capital with minimal downside risk | Secure | – | – | 100% |

This table provides an overview of each fund’s investment objectives, risk-return profile, and the allocation percentages across equity, debt, and money market instruments. Below is sample of their age based fund management strategy.

Summary:

Kotak T.U.L.I.P stands out as a versatile financial tool for those aiming to balance insurance coverage with investment growth. Its diverse features and benefits make it an attractive option for individuals seeking to secure their family’s future while building a substantial financial corpus.

Disclaimer – Think, Learn and Invest

Paid Financial Consulting to choose right insurance and mutual fund